Critical Financial Reports You Need to Manage Your Business

In the beginning stages of your business you’re focused on developing the service or product you’re planning to sell. Then your focus shifts to marketing and getting people to actually purchase your services or products. Once you have customers your focus is on providing the services or products and continuing to grow your business. Whatever phase your business is in, there is one aspect that often gets pushed to the side as not being a priority…the accounting.

There are many excuses business owners have for not putting it on the top of their to do list….”I’m not good with numbers.” “I don’t have time.” “There’s money in my bank account, I must be doing Okay.” Sound familiar? But the truth is the accounting is important and can only be ignored for so long, because eventually it will be tax time and you’ll be forced to deal with it. But there were five critical financial reports you should be monitoring more frequently than once a year if your business is going to be successful.

Cash Balances

This isn’t necessarily a report, but is something you need to monitor on a daily/weekly basis, depending on your cash position. You need to make sure you have enough money in your account to pay any upcoming bills. With the easy access of online banking, checking your cash balances should be an easy step you can do daily, or at a minimum weekly.

Accounts Receivable Listing

This is a report that shows who owes you money. If you send invoices to your customers for services or products, you should be reviewing your accounts receivable listing on a weekly basis so that you can follow-up with customers that haven’t paid. This allows you to follow-up with them in a timely manner and get the money into your bank account as quickly as possible. In order for this listing to be accurate, it also means you need to stay on top of recording payments that have been received from your customers. It doesn’t reflect well when you contact them about something they have already paid.

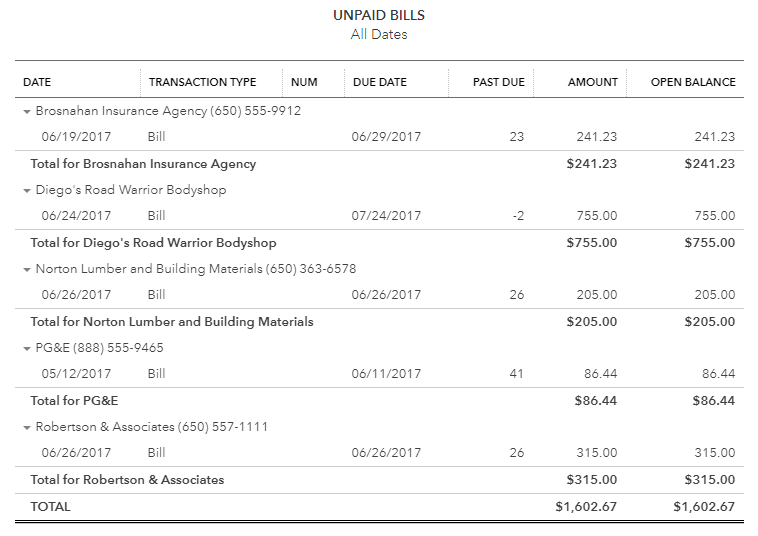

Accounts Payable Listing

This is a report that shows who you owe money – vendors, credit card companies, rent, etc. If you don’t keep track of outstanding bills in an accounting system, you should at a minimum have an unpaid bills file that you monitor on a weekly basis to make sure you are getting your bills paid on time to avoid unnecessary late fees, and keep your vendors happy.

Profit and Loss Statement

This is a report that shows how much income you have made and how much your expenses were. Your income minus your expenses equals your “Net Income” or “Profit”. The Profit and Loss statement gives you a picture of your business activity for a specified period of time – month, quarter, year, etc. You should be reviewing your Profit and Loss statement on a monthly basis, this is the pulse of your business. It can help you answer questions like: Is my income increasing or decreasing? How much is it costing me to provide the services/products I sell? Is my income covering my expenses? With this information you can make informed decisions about your business – Should I increase my prices? Can I afford to hire some help? In addition, on a quarterly basis you should be reviewing your Profit and Loss statement to determine if you need to make estimated tax payments. It can also be helpful to compare your Profit and Loss over a period of time, for example compare the monthly Profit and Loss over the last six months or year to see the trends in your income and expenses. This can give you some insight into the possible seasonality of your business.

Balance Sheet

This is a report that gives you a snapshot of your business at a specified point in time. The balance sheet has three sections: 1) Assets – things you own or amounts that are owed to you, such as cash, accounts receivable, equipment, etc. 2) Liabilities – amounts owed to others, such as balances owed to vendors, credit card balances, loan balances, etc., and 3) Equity – this is the net value of your business, the assets minus the liabilities. It is made up of money you have contributed to the business, less money you have taken out of the business, plus any accumulated net income of your business, typically referred to as retained earnings. Unlike the Profit and Loss that gives you a picture of your business over a period of time, the Balance Sheet is a picture at a single point in time. It is helpful to compare the Balance Sheet from month to month, year to year, to see how healthy your business is – if your liabilities are greater than your assets, that’s not a good sign!

The ability to prepare the above financial reports on a regular basis is difficult to do without an accounting system in place. Thankfully there are many options available so you can find something that fits your needs. The key to a successful accounting system is:

Getting it set-up properly for your business,

Getting the necessary training so you know how to use it, and

Actually using it!

I work with business owners everyday using QuickBooks Online, and I’m also a reseller so I can save you money on your subscription. If you purchase your subscription directly through Intuit you might save 50% for 3 months, depending on the deal they have going on. I can save you 50% off for the first 12 months of your subscription, plus a 30 day free trial. That can be worth up to $300 off the retail price!

I also offer a FREE 15-minute consultation to help you make sure you’re getting the right version to meet your needs.